Each year, 50 million startups are launched, averaging 137,000 daily. Yet, only 10% survive long-term, highlighting the daunting 90% failure rate in the global startup landscape. First-time founders face even tougher odds, with an 18% success rate. In this blog, we’ll explore essential tips for navigating the early stages of startup fundraising to help you defy the odds.

Key Highlights

💡Fundraising involves building relationships, refining business models,managing rejections and above all else perseverance .

💡Personal investment and expert support vs. potential equity loss and growth pressure.

💡Technology partnerships offering specialised expertise, operational efficiency, cost savings, scalability, and competitive edge.

💡Choosing the right tech partner is crucial and involves assessing alignment with goals, needs, and timing.

The What, How, and Why of Fundraising

Raising investment isn’t just about securing cash; it’s about building strong relationships, being willing to refine your business model, and setting your startup up for long-term success. Investors are drawn to startups for the potential of high returns, especially if they can dominate the market. In exchange for their investment, they gain equity, giving them a stake in your success.

But the path to funding is challenging and often filled with rejections. A promising startup might hear “NO” on numerous occasions before landing a “yes.” These rejections aren’t necessarily about your startup’s potential; they often reflect unique concerns or circumstances from each investor. The quality of your investment pitch and your ability to clearly explain and understand the technology underlying your startup are crucial factors. Investors seek confidence that the founding team not only understands their own technology but can also articulate its value and potential. Without this clarity, even a promising idea might struggle to secure funding.

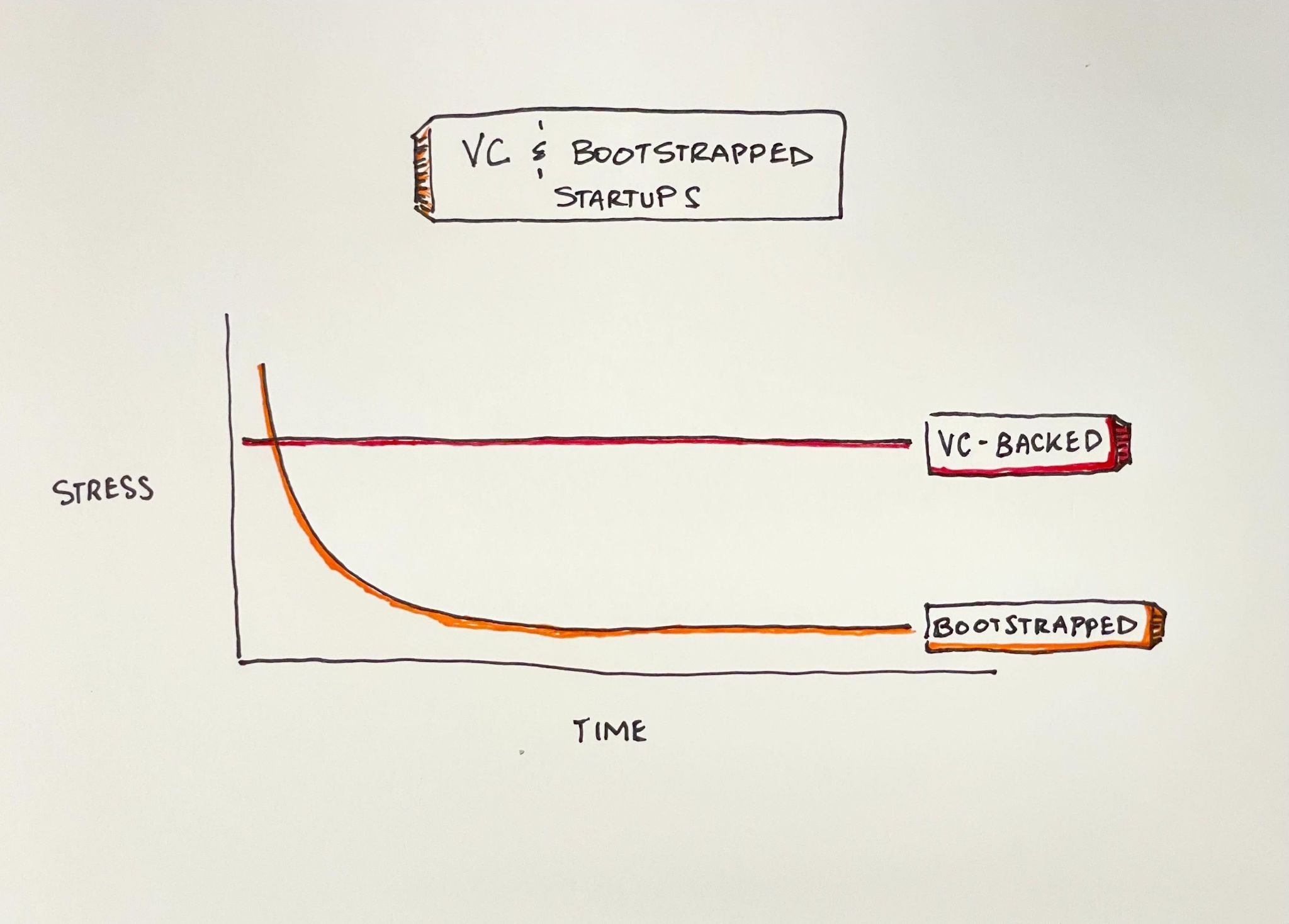

The stress levels associated with different types of funding can vary significantly. The following accompanying graph illustrates this, comparing the stress experienced by founders in VC-backed startups versus bootstrapped startups over time. In VC-backed startups, stress levels tend to remain steady, reflecting the continuous pressure to meet investor expectations and milestones. Conversely, bootstrapped startups often experience higher initial stress as they navigate self-funding challenges, but this stress decreases over time as the business becomes more stable and self-sufficient.

Startup Funding Types for Entrepreneurs

Self-funding or Bootstrapping

Starting a business often involves a key decision: whether to seek external funding or to go it alone. Bootstrapping, or self-funding, is a path that many entrepreneurs choose, relying on personal savings, revenue generated by the business, or even personal loans. This approach offers unique benefits and challenges, shaping the trajectory of the startup in distinctive ways.

Benefits of Bootstrapping

- Complete Control and Autonomy

- Enhanced Flexibility and Quick Adaptation

- Emphasis on Generating Revenue

Downsides of Bootstrapping

- Limited Financial Resources

- Slower Growth Pace

- Personal Financial Risk

⚡Pro-tip: Explore partnerships, collaborations, or barter arrangements to access needed resources without significant financial outlays.

Angel Investors or Business Angels

Angel investors are private individuals who invest their personal funds into new or growing businesses. These investors often come from successful entrepreneurial backgrounds themselves and have a keen interest in nurturing emerging ventures. By providing capital, angel investors help startups secure the necessary resources to develop and scale their operations. In return, they typically receive an equity stake in the company, sharing in its potential growth and success. The concept of angel investing has gained broader recognition thanks to popular media, such as the television show “Shark Tank.” This show features entrepreneurs presenting their business ideas to a panel of seasoned investors, who may offer funding in exchange for equity.

Pros of Angel Investments

- Angels invest their own money and are often negotiable.

- They provide capital for an ownership stake rather than requiring repayment.

- Angels offer expert support, contacts, and guidance.

Cons of Angel Investments

- Business owners may give away 10% to 50% of their company and face potential loss of decision-making power.

- Angels often expect a substantial return on investment, putting pressure on the business to grow quickly.

- Different visions for the company’s future can arise, potentially leading to disagreements with the investor.

Venture Capitalists (VCs)

Venture capitalists (VCs) are investors who provide funding to startups and early-stage companies, typically in exchange for equity stakes. They focus on tech-driven sectors like fintech, renewable energy, and e-commerce, often favouring companies with strong environmental, social, and governance (ESG) credentials. VCs nurture these startups, offering capital and guidance, with the aim of achieving significant returns on their investments. They often exit through the help of investment bankers. VCs charge management fees and share profits with their investors.

Pros of Venture Capitalists (VCs)

- Provides significant funding for startups that might not qualify for traditional loans.

- Offers strategic advice and mentorship to help businesses grow and scale.

- Association with reputable VCs can enhance a startup’s credibility and attract further investment.

Cons of Venture Capitalists (VCs)

- VCs may demand significant control or influence over business decisions and strategic direction.

- Imposes pressure to achieve high growth and returns, often with aggressive timelines.

- The focus on quick returns can lead to pressure for an early exit or acquisition, sometimes at the expense of long-term goals.

Accelerators versus Incubators

Startup accelerators and incubators both offer valuable support but differ in focus and approach. Accelerators are geared towards early-stage companies with an existing product or market fit, aiming for rapid growth over a 3-6 month period. They provide mentorship, networking, and funding in exchange for equity. In contrast, incubators support startups at the idea or early development stage, offering resources like office space and mentorship without immediate equity demands. They focus on nurturing ideas and business models over an extended period. Choosing between them depends on your startup’s stage, growth goals, and funding needs.

Here’s a quick comparison between accelerator and incubator for your ease of understanding:

| Feature | Accelerators | Incubators |

| Stage of Entry | Early-stage with existing product | Seed-stage or idea phase |

| Duration | 3-6 months | Flexible, often longer-term |

| Funding | Provides funding, often in exchange for equity | May provide limited funding or none |

| Support | Mentorship, networking, workshops | Mentorship, office space, resources |

| Acceptance Criteria | Highly selective, competitive | More lenient, varies by incubator |

⚡Pro-tip: Choose an accelerator for rapid growth and investor access, and opt for an incubator if you need extended support and resources to develop early-stage ideas.

Role of a Technology Partner for Startup Success

Partnering at the earliest stage with a technology specialist that understands both the financial and technical (pressures, demands, expectations??) for a start up is crucial for successful fundraising. Tech partnerships provide access to specialised expertise and cutting-edge solutions that many startups lack internally. This collaboration helps optimise your technology infrastructure, demonstrating to investors that your startup is well-prepared and scalable. An experienced tech partner can streamline operations, allowing startups to focus on core business activities while managing IT complexities. They also bring industry-specific knowledge and the latest technologies, which can significantly enhance your startup’s value proposition.

Benefits of Technology Partnerships

Access to Specialised Expertise

Gain: Expertise in cutting-edge technologies and industry best practices.

Impact: Demonstrates to investors that your startup is equipped with advanced solutions.

Operational Efficiency

Gain: Streamlined tech infrastructure and management.

Impact: Frees up resources to focus on core business areas, enhancing growth potential.

Cost Optimisation

Gain: Reduction in overhead costs associated with in-house tech teams.

Impact: More budget available for strategic initiatives and innovation.

Scalability and Flexibility

Gain: Ability to scale tech solutions as your startup grows.

Impact: Shows investors that your startup can adapt to changing needs and market demands.

Credibility and Competitive Edge

Gain: Enhanced technological capabilities and industry insights.

Impact: Builds credibility with investors, showcasing a strong, forward-thinking approach.

Comparison: In-House vs. Technology Partnership

| Aspect | In-house Team | External Technology Partner |

| Expertise | Limited to internal staff skills | Access to broad and specialised expertise |

| Cost | High overheads for hiring, training, and equipment | Lower costs with access to expert solutions |

| Focus | Distractions from core business | Focus on core business while tech partner manages IT |

| Scalability | Limited by internal resources | Easily scalable solutions through resource augmentation models |

When to Choose the Right Partner?

Choosing the right tech partner involves assessing alignment with your strategic goals, technology needs, and timing. Opt for a partner whose expertise complements your business strengths and whose solutions address your specific challenges. Evaluate their track record, scalability, and ability to innovate alongside you. Timing is crucial—ensure your organisation is ready to integrate new solutions and that the partner’s technology aligns with market trends and regulatory requirements. For a seamless collaboration that drives innovation and growth.

Conovo Technologies stands as the ideal technology partner for startups, offering comprehensive expertise to help you navigate the complexities of the tech landscape. We specialise in providing the right technology solutions and crafting strategic roadmaps that align with your business goals. Our deep industry knowledge and innovative approach ensure that your startup is well-positioned to secure funding and scale efficiently. In addition to our technical support, we also offer investment in the form of time and resources, further demonstrating our commitment to your success. Contact us today for a free consultation and find out how we can navigate your startup to the next level.